8 Simple Techniques For Pacific Prime

8 Simple Techniques For Pacific Prime

Blog Article

Pacific Prime for Beginners

Table of Contents8 Simple Techniques For Pacific PrimeIndicators on Pacific Prime You Need To KnowAll about Pacific PrimeGetting My Pacific Prime To WorkThe smart Trick of Pacific Prime That Nobody is Talking About

Insurance policy is a contract, stood for by a policy, in which an insurance holder receives monetary defense or reimbursement against losses from an insurer. The company swimming pools clients' dangers to make repayments much more affordable for the guaranteed. Most individuals have some insurance: for their cars and truck, their home, their health care, or their life.Insurance likewise aids cover costs related to obligation (legal duty) for damage or injury caused to a 3rd event. Insurance is an agreement (plan) in which an insurance provider compensates one more against losses from certain contingencies or hazards. There are many types of insurance coverage plans. Life, health, home owners, and car are among one of the most common forms of insurance coverage.

Investopedia/ Daniel Fishel Many insurance coverage policy kinds are readily available, and essentially any type of individual or business can discover an insurance policy firm willing to guarantee themfor a cost. Most individuals in the United States have at least one of these types of insurance policy, and car insurance is required by state law.

The smart Trick of Pacific Prime That Nobody is Discussing

Discovering the price that is best for you needs some research. Optimums might be set per duration (e.g., yearly or plan term), per loss or injury, or over the life of the policy, also known as the life time maximum.

Policies with high deductibles are generally cheaper due to the fact that the high out-of-pocket expenditure normally leads to fewer tiny insurance claims. There are various kinds of insurance. Allow's check out the most important. Wellness insurance coverage helps covers routine and emergency medical treatment expenses, usually with the choice to add vision and oral solutions separately.

However, numerous preventive solutions may be covered for free prior to these are satisfied. Medical insurance might be bought from an insurance provider, an insurance representative, the federal Health and wellness Insurance Marketplace, provided by an employer, or federal Medicare and Medicaid protection. The federal government no longer requires Americans to have health and wellness insurance, yet in some states, such as The golden state, you might pay a tax obligation charge if you don't have insurance.

The 9-Second Trick For Pacific Prime

Rather than paying out of pocket for car accidents and damage, individuals pay yearly premiums to a vehicle insurance provider. The firm then pays all or most of the covered costs linked more tips here with an auto mishap or other vehicle damages. If you have actually a rented automobile or borrowed cash to acquire an auto, your lender or leasing dealer will likely need you to carry vehicle insurance coverage.

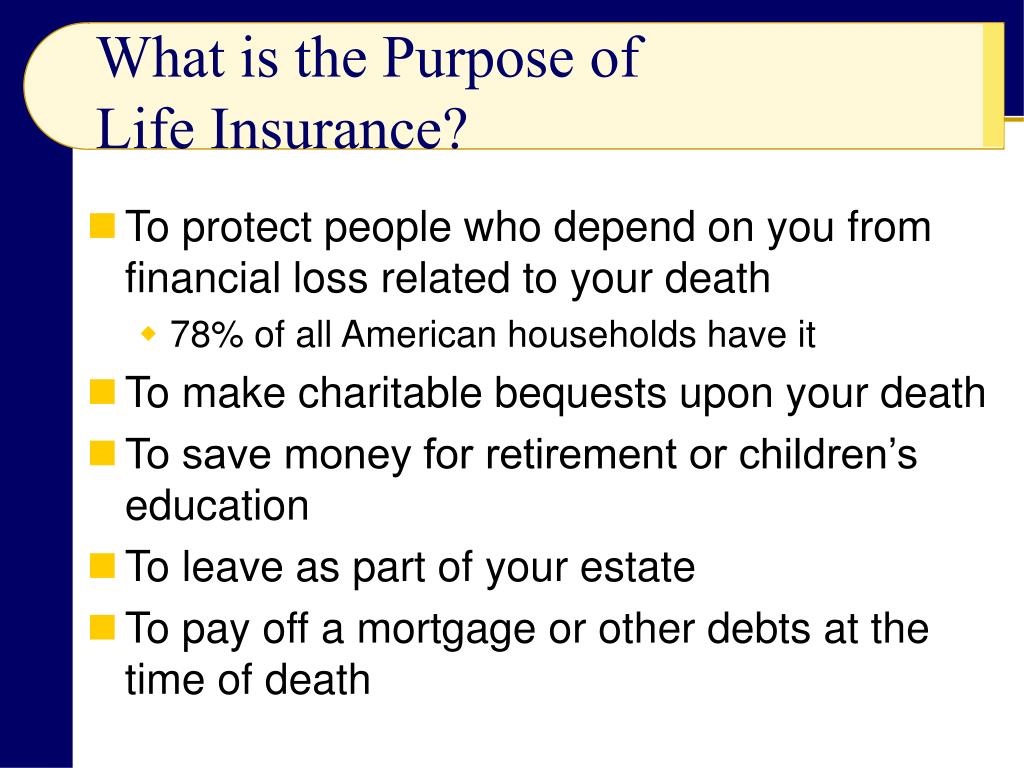

A life insurance plan guarantees that the insurer pays an amount of money to your recipients (such as a spouse or youngsters) if you die. There are two primary types of life insurance policy.

Long-term life insurance policy covers your whole life as long as you continue paying the premiums. Travel insurance coverage covers the prices and losses associated with traveling, consisting of trip terminations or hold-ups, insurance coverage for emergency healthcare, injuries and emptyings, harmed baggage, rental autos, and rental homes. Nonetheless, also several of the best travel insurance policy companies - https://businesslistingplus.com/profile/pacificpr1me/ do not cover terminations or hold-ups as a result of weather, terrorism, or a pandemic. Insurance policy is a way to manage your monetary risks. When you buy insurance policy, you acquire security against unforeseen monetary losses.

An Unbiased View of Pacific Prime

Although there are numerous insurance coverage types, several of the most common are life, health and wellness, homeowners, and automobile. The ideal type of insurance coverage for you will certainly rely on your goals and economic situation.

Have you ever before had a moment while checking out your insurance coverage or purchasing insurance when you've thought, "What is insurance? And do I actually need it?" You're not alone. Insurance can be a strange and confusing thing. Just how does insurance coverage job? What are the advantages of insurance policy? And just how do you find the very best insurance for you? These prevail concerns, and thankfully, there are some easy-to-understand responses for them.

Nobody wants something bad to occur to them. Experiencing a loss without insurance coverage can put you in a tough economic situation. Insurance is a vital financial device. It can aid you live life with fewer fears understanding you'll get economic assistance after a catastrophe or accident, aiding you recuperate faster.

Pacific Prime for Dummies

And in many cases, like vehicle insurance coverage and workers' settlement, you may be called for by law to have insurance policy in order to shield others - international health insurance. Learn more about ourInsurance options Insurance policy is basically a massive wet day fund shared by several people (called insurance holders) and taken care of by an insurance provider. The insurance provider makes use of money collected (called costs) from its insurance policy holders and other financial investments to pay for its operations and to accomplish its guarantee to insurance policy holders when they file a case

Report this page